Massachusetts Housing Finance Agency (MassHousing) Down Payment Assistance Program

Unlock Your First Home With the Massachusetts Housing Finance Agency (MassHousing) Down Payment Assistance Program

For many Bay Staters, the Massachusetts Housing Finance Agency (MassHousing) Down Payment Assistance Program is the missing puzzle piece between dreaming of homeownership and holding a set of house keys. This state-backed initiative delivers up to $15,000 in down payment funds, potentially slashing months—or even years—off your savings timeline. Below, you’ll discover how the program works, who qualifies, and how to position your application for a fast “yes.”

Why Down Payment Help Matters in Massachusetts

Home prices in the Commonwealth have climbed roughly 53 % since 2016, according to a December 2023 analysis of MLS PIN data. Meanwhile, hourly wages rose just 29 %. That math leaves a gap large enough to derail otherwise solid buyers. MassHousing’s assistance is designed to bridge the difference so that teachers in Worcester, software engineers in Cambridge, and healthcare workers in Springfield can all compete with cash-heavy investors.

Snapshot of 2023 Median Home Prices

- Boston–Cambridge–Newton: $799,000

- Worcester Metro: $425,000

- Springfield Metro: $285,000

With a conventional 3 % down payment on a $425,000 home in Worcester, you’d need $12,750 plus closing costs. MassHousing can cover the entire down payment—and then some—while preserving your emergency fund.

How Does the MassHousing Down Payment Assistance Program Work?

The Massachusetts Housing Finance Agency (MassHousing) Down Payment Assistance Program pairs a first mortgage from MassHousing with a second, 15-year amortizing loan of up to $15,000 or 5 % of the purchase price, whichever is less. Because it’s a loan—albeit at a competitive, fixed interest rate—your monthly payment stays predictable, and there’s no private mortgage insurance surcharge on the DPA itself.

Key highlights at a glance:

- Amount: Up to $15,000 or 5 % of purchase price

- Rate & Term: Fixed rate, 15-year second mortgage

- Eligible Properties: 1- to 4-unit homes and condos statewide

- Pairing: Must be combined with a MassHousing first mortgage

Think of the DPA as a booster rocket: it launches you off the rental pad, while the first mortgage is the main engine that carries you through the 30-year orbit of ownership.

Who Qualifies for MassHousing Down Payment Assistance?

Eligibility for the Massachusetts Housing Finance Agency (MassHousing) Down Payment Assistance Program revolves around three pillars—buyer, property, and income.

1. Buyer Requirements

- Must be a first-time homebuyer or not have owned a home in the past three years (veterans are exempt).

- Minimum FICO score of 640 (680 for multi-unit properties).

- Debt-to-income ratio typically ≤ 45 % with compensating factors.

2. Property Requirements

- Owner-occupied 1-4 unit homes, condos, or planned unit developments.

- Purchase price within MassHousing county limits (e.g., $724,000 in Middlesex County for 1-unit homes as of 2024).

3. Income Limits

Income ceilings range from approximately $109,000 in Western MA to $191,700 in parts of Greater Boston, adjusted annually. Because MassHousing updates these figures each spring, checking the latest county table on MassHousing’s official site is crucial.

Is MassHousing Only for First-Time Buyers?

Mostly, yes, but there are strategic exceptions. Veterans and buyers in certain targeted census tracts (areas identified for revitalization) can flip the script and qualify even if they’ve owned a home within the past three years. That means a National Guard member moving back from deployment can leverage MassHousing to re-enter the market without penalty.

Another lesser-known pathway involves purchasing a 2- to 4-unit property. In multi-unit scenarios, up to 30 % of anticipated rental income may be counted toward your qualifying income—an overlooked advantage for aspiring landlords.

Application Timeline: From Pre-Approval to Closing

- Educate Yourself: Complete an approved homebuyer education course (online or in-person) before signing a purchase contract.

- Get Pre-Approved: Approach a MassHousing-approved lender. Not all banks offer the DPA, so confirm before pulling credit.

- Shop & Negotiate: Once pre-approved, shop within your price cap. MassHousing allows seller credits up to 3 %, which can further reduce out-of-pocket costs.

- Lock Rates: Your lender locks both the first mortgage and the DPA second mortgage simultaneously.

- Submit to MassHousing: The lender uploads your file to MassHousing’s portal for compliance review—usually a 48-hour turnaround.

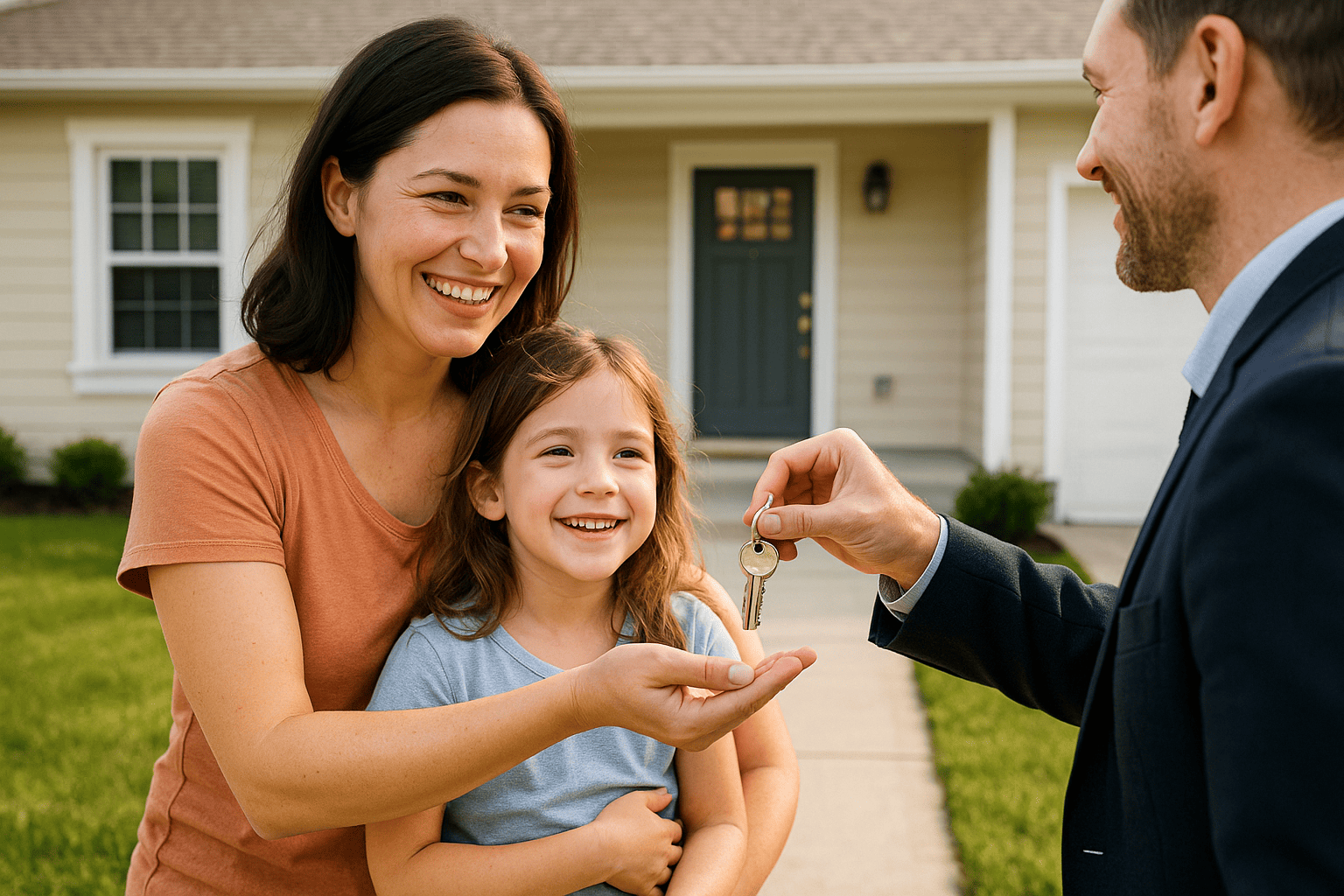

- Close & Move: Sign two promissory notes (first and second mortgage). Congratulations—you’re a homeowner.

A Real-World Success Story: Jordan & Maya in Springfield

In August 2023, Jordan (a paramedic) and Maya (a substitute teacher) were paying $2,050 in rent for a two-bedroom apartment. With only $7,000 in the bank, a 3 % down payment on even a modest $300,000 home felt distant. Their loan officer suggested the MassHousing down payment program. Within six weeks, they closed on a renovated Cape Cod-style home for $285,000. Using a $14,250 second mortgage from MassHousing, they kept $5,800 of their savings intact for future repairs. Their new monthly payment? $2,073—a mere $23 increase for ownership, equity, and a backyard for Maya’s herb garden. This isn’t a marketing fairy tale; it’s a signal that middle-income buyers can prevail, even in competitive markets.

Pros & Cons at a Glance

Advantages

- Up to $15,000 toward down payment with predictable, fixed payments.

- No age or marital status restrictions—solo buyers welcome.

- Layerable with local grants (Boston’s ONE+Boston, Quincy’s FTHB grant).

- Subsidized mortgage insurance rates on the first mortgage.

Possible Drawbacks

- Second mortgage adds a small monthly payment (~$105 on $15k at 6 %).

- Income caps may exclude higher-earning households in pricey zip codes.

- Property must be owner-occupied for the life of the second mortgage.

How to Strengthen Your Application

Even with state support, you’ll compete with buyers waving cash. Here’s how to gain an edge:

- Boost Credit: Raising your FICO 20 points could shave 0.25 % off your first-mortgage rate.

- Document Funds Clearly: Large transfers trigger extra verification. Keep deposits under 50 % of monthly income—or be ready with a paper trail.

- Write a Cover Letter: Sellers in Massachusetts often review personal letters. A concise, heartfelt note can humanize your offer.

According to an internal survey by a regional brokerage, offers including a buyer letter had a 17 % higher acceptance rate in Worcester County during 2023. Sometimes, soft skills outweigh hard cash.

Cost Breakdown: Example on a $400,000 Purchase

| Item | Without DPA | With MassHousing DPA |

|---|---|---|

| Down Payment (3 %) | $12,000 | $0 (covered) |

| Estimated Closing Costs | $7,500 | $7,500 |

| Cash Needed | $19,500 | $7,500 |

| Monthly Payment* | $2,690 | $2,775 (includes DPA loan) |

*Assumes 6.0 % first-mortgage rate and 6.5 % DPA rate, 30-year term, taxes & insurance included.

How Do I Apply for MassHousing Down Payment Assistance?

Start by locating a MassHousing-approved lender. A complete list lives on MassHousing’s website. Once you pre-qualify, you’ll:

- Provide two years of W-2s, recent pay stubs, and bank statements.

- Complete a HUD-approved or CHAPA-approved first-time buyer course.

- Submit a purchase offer within 90 days of pre-approval to keep paperwork fresh.

- Finalize both the first and second mortgages during underwriting.

Pro tip: schedule your homebuyer education early. Classes can fill three weeks ahead in high-demand months (April–June).

FAQ

What credit score do I need for MassHousing?

The minimum is 640 for single-unit homes and 680 for 2-4 unit properties, though higher scores unlock better rates and more flexible debt-to-income ratios.

Can I combine MassHousing with FHA?

No. MassHousing provides its own conventional or FHA-alternative first mortgage. The DPA must pair with that specific loan product.

Is there a prepayment penalty on the DPA loan?

None. You can pay off the 15-year second mortgage early—monthly, annually, or at sale—without fees.

Does the program cover closing costs?

Not directly, but seller credits up to 3 % and lender credits can be used. Some municipalities offer separate grants you can layer on.

Your Next Step Toward Massachusetts Homeownership

What credit score do I need for MassHousing?

The minimum is 640 for single-unit homes and 680 for 2-4 unit properties, though higher scores unlock better rates and more flexible debt-to-income ratios.

Can I combine MassHousing with FHA?

No. MassHousing provides its own conventional or FHA-alternative first mortgage. The DPA must pair with that specific loan product.

Is there a prepayment penalty on the DPA loan?

None. You can pay off the 15-year second mortgage early—monthly, annually, or at sale—without fees.

Does the program cover closing costs?

Not directly, but seller credits up to 3 % and lender credits can be used. Some municipalities offer separate grants you can layer on.

The Massachusetts Housing Finance Agency (MassHousing) Down Payment Assistance Program turns the dream of owning a colonial in Plymouth or a loft in Lowell into a grounded, numbers-backed plan. By stitching together state funds, education, and a community of approved lenders, the program fills a funding gap that the private market often overlooks.

Ready to turn “someday” into a closing date? Our in-house lending team specializes in MassHousing DPA files and can issue a pre-approval in 24 hours. Schedule a free strategy call today, and let’s map out your path from lease to deed.

Explore More Blog Posts

Checkout more similar posts those will help you to choose better property.

Profile

Profile Password

Password Saved Properties

Saved Properties Sign Out

Sign Out

+0.01

+0.01

-0.15

-0.15