Omaha Down Payment Assistance Program

The Complete Guide to the Omaha Down Payment Assistance Program for First-Time Homebuyers

Dreaming of a front porch in Benson or a condo overlooking the Old Market? The Omaha Down Payment Assistance Program could make that vision real—without draining your savings. This comprehensive guide demystifies the city-backed initiative, explains who qualifies, and reveals how to harness the funds to unlock your new Nebraska address.

Why Down Payment Assistance Matters in the Metro

Rents in Douglas County climbed roughly 27% between 2019 and 2023, according to a regional housing dashboard. Meanwhile, the median down payment for FHA buyers in the county landed near $12,800 last year—an amount that can feel Everest-high when you’re juggling student loans or childcare costs. The City of Omaha responds to that affordability gap with a targeted financial lifeline for first-time buyers.

Program Snapshot

- Name: Omaha Down Payment Assistance Program (DPA)

- Administered by: City of Omaha Planning Department Housing and Community Development Division

- Assistance type: Deferred-payment, zero-interest loan or forgivable grant (depending on household income bracket)

- Maximum amount: Up to $10,000 toward down payment and closing costs

- Primary funding source: HUD HOME Investment Partnerships Program

How Much Can You Receive From the Omaha Down Payment Assistance Program?

The city scales assistance based on income. Households earning up to 80% of the area median income (AMI) may qualify for the full $10,000, while those in the 81–100% AMI tier typically cap at $5,000. Funds cover:

- Minimum required down payment (e.g., 3% for conventional or 3.5% for FHA)

- Reasonable closing costs such as appraisal, origination, and title fees

Because the money arrives as a deferred loan, repayment is postponed until you sell, refinance, or move out within the lien period (usually 5–10 years). Stay in the home long enough, and the balance may be entirely forgiven—an invisible gift that keeps on giving.

Who Is Eligible for Omaha Down Payment Assistance?

You don’t need a perfect credit score or a six-figure salary. However, you must meet specific guardrails:

- First-time buyer status: No ownership of a principal residence in the last three years.

- Income limit: ≤ 100% AMI (adjusted for household size). As of spring 2024, that’s roughly $98,000 for a family of four.

- Property location: Home must lie within Omaha city limits.

- Home price cap: Set annually—currently $294,000 for existing homes and $330,000 for new builds.

- Education requirement: HUD-approved eight-hour homebuyer class plus one-on-one counseling.

Pro tip: Lenders often overlay their own rules (e.g., 640 minimum FICO). Shop around, because some credit unions waive origination fees for buyers using local down payment help.

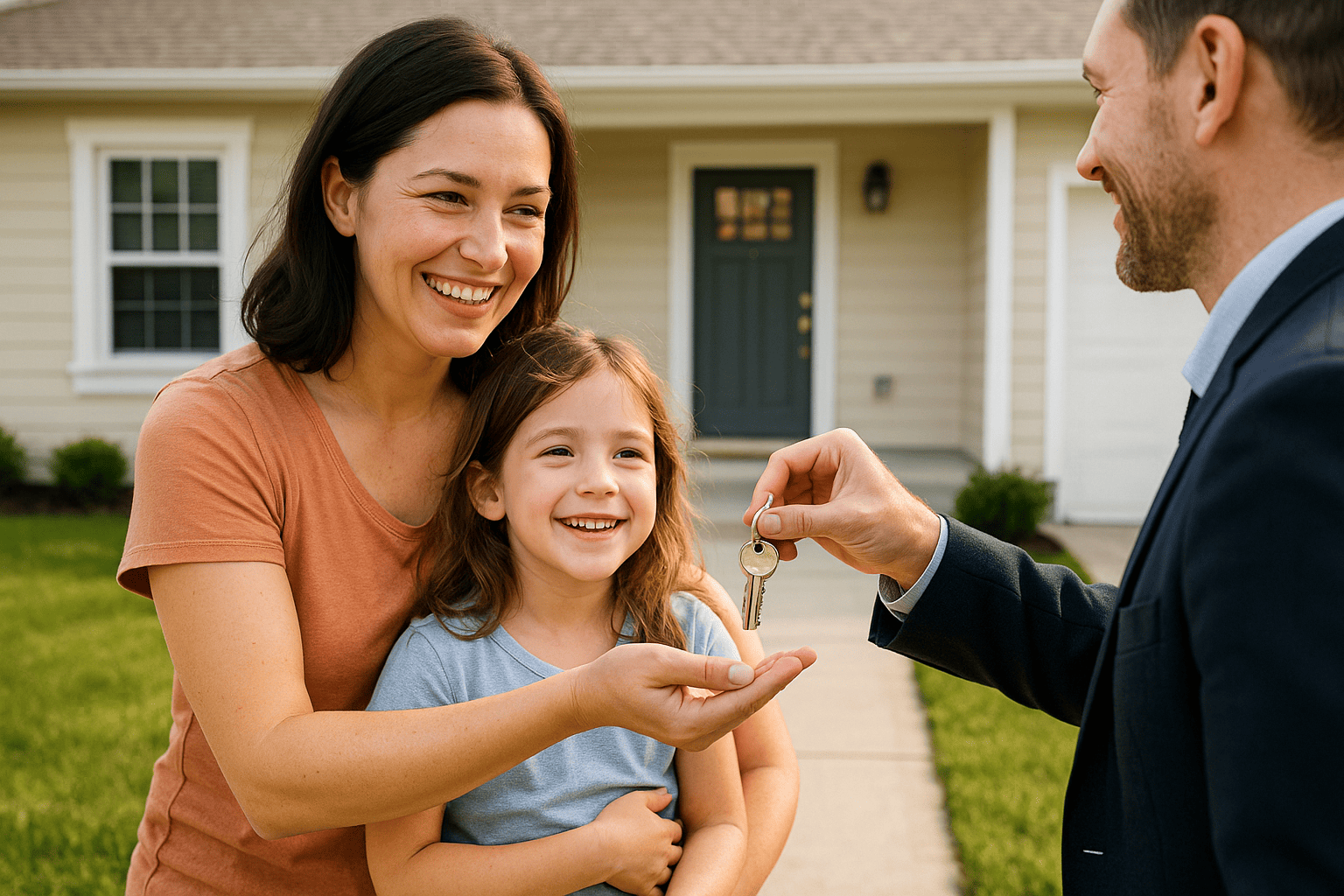

A Real-World Success Story: Sarah & Jordan’s Midtown Nest

On a windy March afternoon, Sarah (a nurse) and Jordan (an IT technician) closed on a two-bedroom bungalow near UNMC. Their combined income: $79,500—comfortable, yet not enough to stash away $15,000 in cash. They discovered the Omaha Down Payment Assistance Program at a neighborhood workshop, completed counseling on Zoom, and landed a $9,200 deferred loan. The couple poured their own $1,000 into the deal, painted the porch teal, and now host Sunday barbecues instead of paying $1,500 in monthly rent.

Key Benefits Beyond the Dollar Amount

Money is only part of the equation. Below are additional perks that buyers often overlook:

- Lower monthly payments: Bigger down payments shrink principal and possibly eliminate mortgage insurance faster.

- Counseling safety net: Post-purchase workshops help prevent delinquencies—data from a 2022 HUD brief shows counseling can reduce default odds by 29%.

- Equity acceleration: Omaha’s average annual appreciation hovered near 7% over the past decade, according to localized Zillow aggregates.

- Community stability: Owner-occupancy correlates with lower neighborhood crime, a win for everyone on the block.

Step-by-Step Application Timeline

- Attend a HUD-certified class. Local nonprofits such as Family Housing Advisory Services host sessions twice monthly.

- Secure mortgage pre-approval. Bring your lender’s pre-qual letter to counseling.

- Submit the DPA packet. Includes income docs, purchase agreement, and property inspection notes.

- City review & underwriting. Typical turnaround: 10–14 business days. Peak spring season may extend timelines.

- Closing coordination. City wires funds to the title company 24–48 hours before signing.

Think of the process like assembling a baseball lineup: counseling leads off, underwriting bats cleanup, and the title company scores the winning run at home plate. Miss one player, and the game drags into extra innings.

Is Omaha DPA a Loan or a Grant?

The short answer: both, depending on your income tier and how long you own the home. For households below 80% AMI, the city records a zero-interest lien that fully forgives after a five-year residency period. Buyers closer to 100% AMI often receive a longer-term lien—still interest-free but repayable at sale if you move prematurely. Either way, no monthly payments mean your budget breathes easier every single month.

Other Nebraska Down Payment Programs to Stack

If the Omaha Down Payment Assistance Program doesn’t cover everything, consider combining:

- NIFA Homebuyer Assistance (HBA): statewide option offering up to 5% of purchase price as a second mortgage.

- Federal Home Loan Bank HomeStart: grants up to $7,500 through participating banks.

- Employer-assisted housing: Several Omaha hospitals match up to $5,000 for employees buying within certain ZIP codes.

Layering these sources takes choreography—lender overlays, separate inspections, multiple closings. Yet the savings can eclipse $20,000, enough to furnish that dream kitchen island.

How Do I Apply for the Omaha Down Payment Assistance Program?

Start by visiting the city’s housing portal (cityofomaha.org). Download the “Homebuyer Assistance Application,” read the instructions twice, then line up these documents:

- Last two months of pay stubs and bank statements

- Previous year’s tax return

- Signed purchase agreement

- Proof of completion of an approved education course

Submit the packet via your lender or directly to the Planning Department. Follow up within five business days; responsiveness signals readiness and can bump your file to the top of the pile.

Common Pitfalls & How to Dodge Them

- Expired paperwork: Income docs older than 60 days trigger re-verification.

- Home inspection gaps: Properties must meet City of Omaha Minimum Rehabilitation Standards. Peeling lead-based paint? Fix it before reinspection.

- Over-budget offers: Even an accepted offer above the price cap voids your assistance.

- Skipping homeowner’s insurance shopping: A lower premium can nudge your debt-to-income (DTI) within lending limits.

Why trip on pebbles when the path is clearly marked? A quick checklist review could save weeks of delays.

The Bigger Picture: Economic Upsides for Omaha

Every funded mortgage generates ancillary spending—paint, appliances, landscaping. A University of Nebraska economic analysis estimates that for each home sale, just over $91,000 in local ripple effects swell into the metro economy. By easing the entrance fee, Omaha’s DPA program essentially primes a pump that nourishes small businesses from Dundee hardware shops to South Omaha garden centers.

When you leverage Omaha down payment help smartly, you’re not just buying a roof; you’re investing in neighborhood vibrancy. The Omaha first-time buyer assistance model has even inspired smaller cities like Kearney to pilot similar initiatives. That ripple—starting with a single front door—proves that Omaha homebuyer grants can echo far beyond the closing table.

Quick-Hit FAQs

Townhomes and condos qualify if they’re fee-simple or warrantable; mobile homes on leased land do not.

Yes. Veterans can layer Nebraska down payment aid with a VA mortgage, provided total assistance doesn’t exceed closing costs.

The city has no formal FICO rule, but partner lenders typically require 640.

Only if the repairs are tied to health and safety issues found during inspection and approved by the city.

Average of 14 days, but plan for up to 30 in peak seasons.

Unlock Your Omaha Home Today

Every housing journey begins with a single step—why not let the City of Omaha share the stride? Check your eligibility, enroll in a counseling session, and let the Omaha Down Payment Assistance Program turn “someday” into move-in day. If you’re ready to start, visit cityofomaha.org/housing or call the Housing and Community Development Division at (402) 444-5206.

Suggested URL slug: /blog/omaha-down-payment-assistance-first-time-buyers-guide

Explore More Blog Posts

Checkout more similar posts those will help you to choose better property.

Profile

Profile Password

Password Saved Properties

Saved Properties Sign Out

Sign Out

+0.01

+0.01

-0.15

-0.15